Liberia Tax Reform: A New Chapter in African Fiscal History

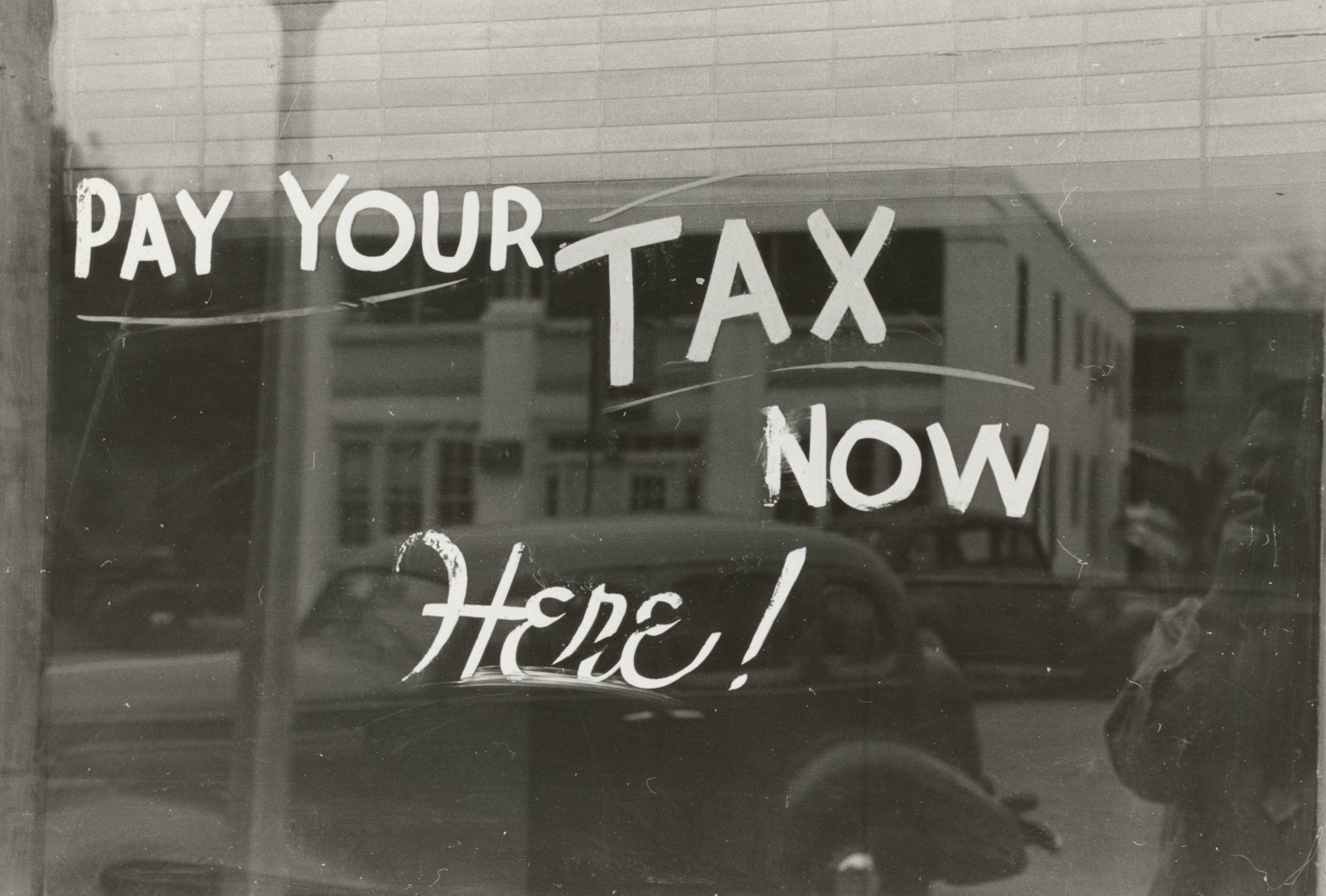

In the heart of West Africa, a quiet revolution is taking shape. Liberia, long burdened by economic hardship and governance challenges, is embarking on an ambitious journey to transform its tax system. Under the leadership of Mary Baine, a prominent figure in fiscal reform, the country is aligning revenue policy with democratic accountability. Liberia Tax Reform is more than an administrative overhaul—it’s a test of political will, civic trust, and regional innovation.

This shift marks a turning point in how African governments engage with their citizens. For decades, taxation in Liberia was seen as opaque and disconnected from public services. Today, the reform aims to change that perception, placing transparency, representation, and inclusion at the center of national policy. As Mary Baine ushers in this new era, Liberia is poised to set an example for the continent and beyond.

Liberia Tax Reform: The Legacy of Dysfunction: Why Liberia Needed a Tax Reform

The need for Liberia Tax Reform did not arise overnight. Years of post-conflict instability, a weak institutional framework, and reliance on foreign aid eroded public confidence in the state’s ability to collect and manage revenue. Tax evasion, outdated systems, and a narrow tax base left the government struggling to finance even basic services such as education and healthcare.

What made matters worse was the disconnect between taxpayers and the government. Many Liberians viewed taxes as an imposed burden with no visible return. This led to a culture of non-compliance and informal economies flourishing outside state control. The World Bank and the IMF had long urged reforms, but without domestic ownership, earlier efforts faltered. That is now changing.

With Mary Baine at the helm, reform is being framed not just as a financial necessity, but as a pathway to rebuild trust. Her approach places equal weight on civic education, legal reform, and technological modernization—creating a more equitable and efficient system.

Liberia Tax Reform: Revenue Meets Representation: The Power of Inclusive Tax Policy

One of the most transformative ideas behind Liberia Tax Reform is the principle that taxation must reflect the voices of the people. The reform emphasizes the link between what citizens pay and the services they receive. This approach reawakens the classic democratic ideal: no taxation without representation.

To bring this idea to life, the reform includes extensive public consultations and townhall meetings across all 15 counties of Liberia. Citizens are not only informed about new tax laws, but actively involved in shaping them. This participatory process builds legitimacy and reduces resistance, especially among small business owners and informal traders.

According to a report from Africanews, community tax forums have already resulted in a 12% increase in voluntary compliance in just one year. It is a promising sign that when citizens see how their money is used, they become more willing to contribute.

Digital Infrastructure and Transparency: Laying the Foundations

No reform can succeed without the right tools. That’s why a cornerstone of Liberia Tax Reform is the implementation of digital tax systems. Gone are the days of paper ledgers and opaque processes. Through a new e-filing platform and taxpayer identification system, the government is streamlining collections and reducing leakages.

This technological shift is supported by regional digital governance efforts, including models developed in Rwanda and Ghana. Liberia is also collaborating with external partners, such as the African Tax Administration Forum (ATAF), to build technical capacity and ensure compliance with international standards.

Challenges Ahead: Navigating Political and Social Obstacles

Despite the promising start of Liberia Tax Reform, significant challenges remain. Political resistance from entrenched interests threatens to slow progress, as some stakeholders fear losing influence or revenue streams. Moreover, social skepticism fueled by years of distrust means that public buy-in cannot be taken for granted. To overcome these hurdles, Mary Baine’s team is engaging in continuous dialogue with civil society organizations, traditional leaders, and international donors to maintain momentum and build broad-based support.

This approach aligns with lessons learned from other African nations where tax reform efforts faced similar obstacles but succeeded through inclusive governance and persistent advocacy. The government’s commitment to transparency and accountability remains critical for sustaining trust and ensuring the reform’s longevity.

Empowering Local Governments: Decentralization of Tax Authority

Another cornerstone of the Liberia Tax Reform is the decentralization of tax administration. By empowering county and district authorities to manage certain aspects of tax collection and enforcement, the reform seeks to improve efficiency and responsiveness to local needs. This shift helps reduce bureaucratic bottlenecks and allows communities to directly see the benefits of tax revenues invested in their areas.

Studies from neighboring countries, such as Ghana and Senegal, highlight the positive impact of decentralization on public service delivery and citizen engagement. Liberia is leveraging these regional experiences to tailor its decentralization strategy for maximum impact.

Building Capacity: Training and Technology for Tax Officials

Effective implementation of Liberia Tax Reform depends heavily on the skills and resources available to tax officials at all levels. Recognizing this, the government has launched comprehensive training programs focused on modern tax administration techniques, ethical standards, and the use of digital tools. These programs are designed in collaboration with international partners like the African Tax Administration Forum (ATAF) and the International Monetary Fund (IMF).

The integration of technology—such as mobile payment platforms and data analytics—equips officials to better detect fraud and improve compliance. This dual focus on human and technological capacity is a critical step toward a sustainable and fair tax system in Liberia.

Economic Impact: Boosting Growth Through Tax Reform

The Liberia Tax Reform aims not only to improve government revenue but also to stimulate economic growth. By broadening the tax base and simplifying compliance, the reform encourages entrepreneurship and investment. Lowering administrative barriers for small and medium enterprises (SMEs) creates a more conducive environment for business expansion, job creation, and innovation.

According to recent data from the World Bank, countries that implemented similar reforms have seen an average GDP growth increase of 1.5% within the first two years. Liberia is optimistic that these changes will help reduce poverty and foster sustainable development across its diverse regions.

Social Equity: Fairness in Taxation as a Path to Unity

Equity is a central pillar of Liberia Tax Reform. The government is committed to ensuring that the tax burden is shared fairly across different income groups, reducing inequality and fostering national unity. Progressive taxation measures and targeted subsidies for vulnerable populations are key components of this approach.

Engaging marginalized communities in tax discussions has helped to address historic grievances and increase trust in public institutions. This social dimension of tax reform supports Liberia’s broader goals of reconciliation and inclusive governance.

Looking Forward: Sustaining Momentum for Lasting Change

As Liberia continues to implement its ambitious tax reform agenda, sustaining momentum will require ongoing political will, citizen engagement, and adaptive strategies. The government is setting up monitoring mechanisms to track progress, evaluate impacts, and make necessary adjustments in real time.

International partnerships remain vital, providing technical assistance and financial support. With strong leadership and collective effort, Liberia Tax Reform has the potential to become a model for fiscal transformation across Africa.

Explore more on sustainable governance in Africa at Voicemauritiusnews.